Brand Architekts is a British challenger-brand business operating in the beauty sector, focused on:

- insight-led, problem-solving and profitable brands

- ethical and efficient outsourcing

- digital 1st brand invigoration

- omni-channel routes to market

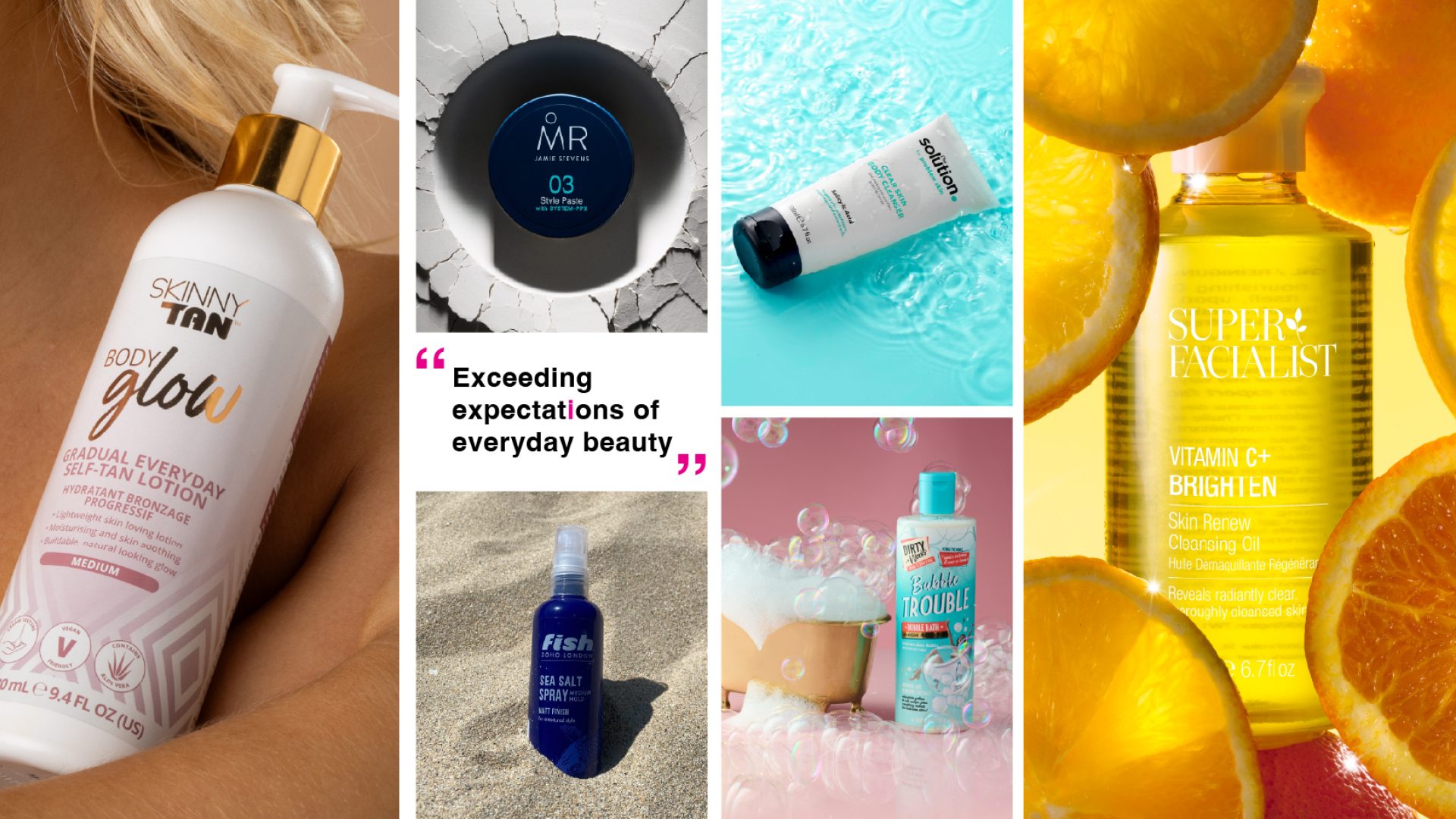

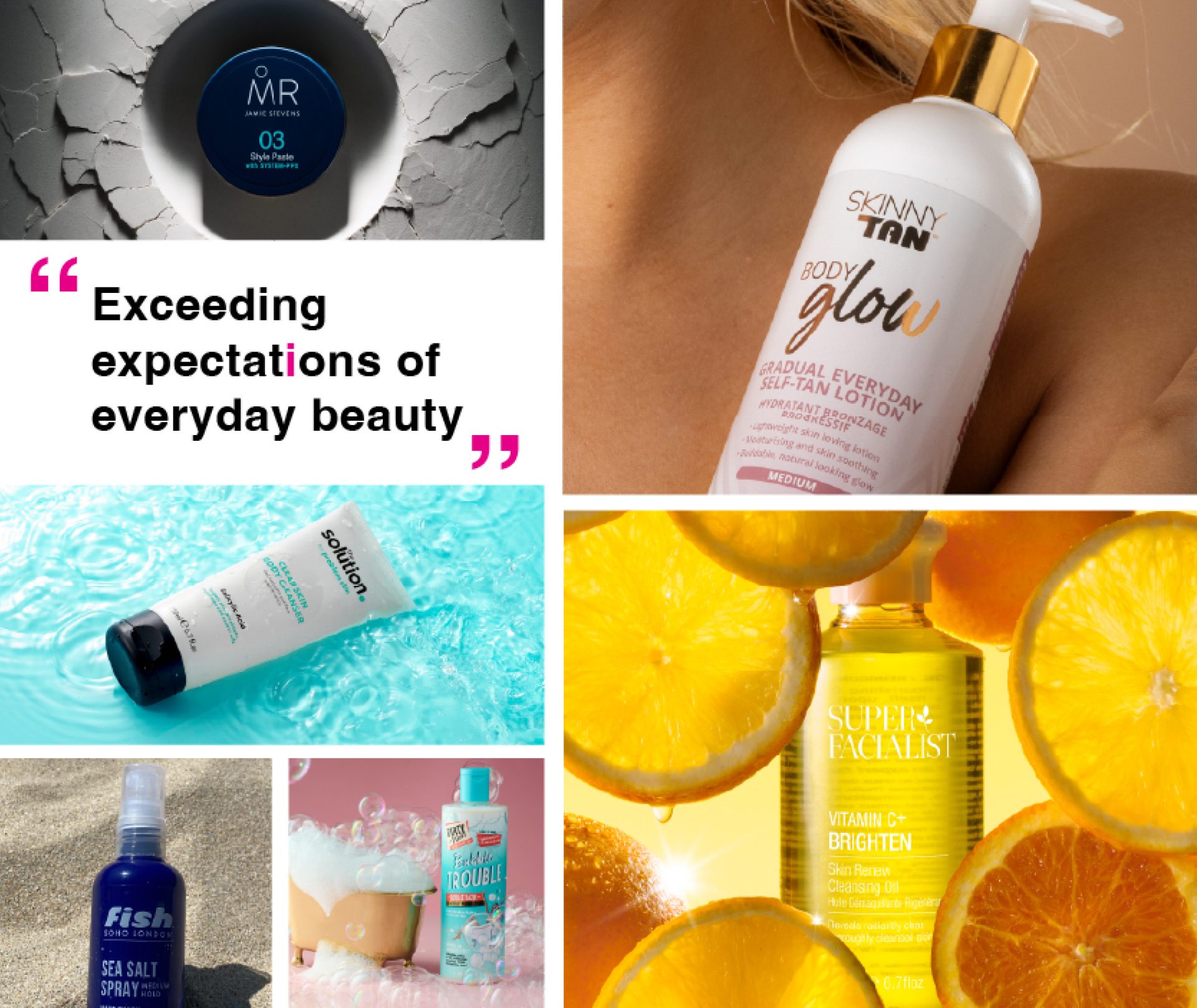

Brands

The Group has a rapidly growing portfolio of innovative, problem-solving brands, developed within Brand Architekts, which are marketed and distributed to leading retailers in the UK and internationally.